Money, so they say, is the root of all evil today.

– Pink Floyd

Robie and I haven’t talked about the most important factor dictating our roving retirement. But after reading posts from A Purple Life and fielding questions from enquiring minds, we realize that people looking to travel long-term in retirement have questions about finances. Because chucking it all to become homeless nomads isn’t for the faint of heart. Or the underprepared.

So, for anyone interested in figuring out how to afford a roving retirement, this post is for you. And for those who prefer cute goat videos or stray cat stories, feel free to stop reading now.

We promise to post more of your favorites soon.

Budget

The most crucial aspect of any financial goal is a budget. Because without it, Robie and I would probably end up on the streets of Mexico selling chicle. Or worse, returning home to work as Walmart greeters.

Before leaving the States, Robie spent months researching the cost of living and rental properties in northern Spain, the region where we originally planned to move. And during an exploratory trip we reconned grocery stores and ate in tapas bars for filling, inexpensive meals that are part of the local culture.

After our plans changed and we pivoted to a roving retirement, we tweaked the budget and put more dollars into travel and transportation. And since we were no longer looking for a long-term place to call home, we needed to add a storage facility to hold the few belongings we intended to keep.

Accommodations

Just like in the States, a huge chunk of our monthly expenses goes toward having a bed to sleep in and putting a roof over our heads. The place needs to be safe, comfortable, centrally located and come with a functional kitchen as well as workstation. And because we stay in each location for three months or longer, we can negotiate deals that are often lower than the listed rate.

In Liverpool we chose a 2-bedroom apartment because there wasn’t a living room and turned the second bedroom into one. On Ikaria we opted for an apartment with an open floorplan that had a tiny kitchen but an amazing view of the Mediterranean off our balcony. In Sarandё we found a large 1-bedroom unit with separate kitchen and living area that also had a balcony overlooking the water. And in Essaouira, Morocco where we’ll spend the winter, we’ve selected a modern apartment near the beach.

Food

Some folks prefer to eat out every day, but for us that’s not practical.

While Robie and I eat out when we travel, at home we prefer to cook meals and limit eating at restaurants to once a week. It’s why we brought along a chef roll with our favorite knives, sharpener, wooden spoon and spatulas. It also means we have to take time to plan meals and make trips to the market, but we enjoy learning to cook local dishes like avgolemono soup and Bekre meze.

Still, it’s important our budget doesn’t keep us from joining friends for last-minute invitations or scrapping a planned meal in for a spontaneous dinner out. So, having items in the pantry and a mental rolodex of quick and easy recipes helps us stay flexible, on track and underbudget.

Tracking expenditures

Having a budget is useless unless we track every penny. So daily Robie and I jot down the 50 cents we spent to access the pay toilet at a rest stop and include the 80-cent tip to our waitress. (Yes, 80 cents because in Europe servers are paid a living wage and don’t rely on customers for their livelihood).

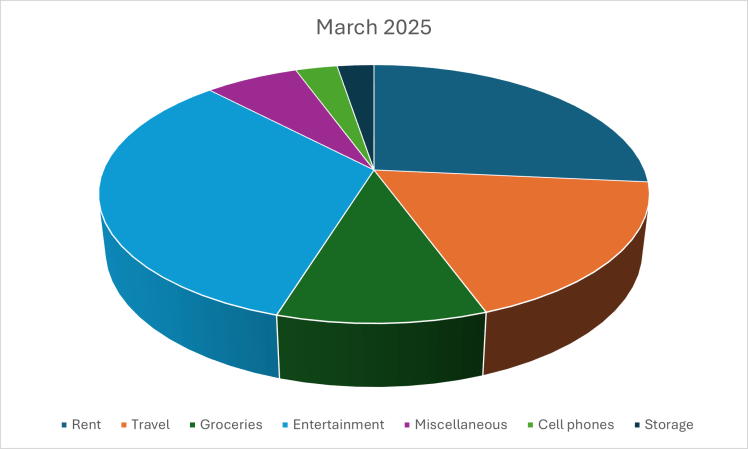

But the last thing we wanted to do in retirement was get bogged down in minutia, so keeping the accounting tasks simple was key. Our budget is a spreadsheet we can access from any device with line items for monthly cell phone charges and the fee for the storage facility in Dallas. There’s a category for groceries and that catch-all miscellaneous. But alongside rent, our biggest expenditures are travel and entertainment.

Under entertainment goes everything from a morning cup of joe at the café to dinner out and entrance fees to sites. And since the whole point of our roving retirement is to travel, we budget one trip a month. It can be as simple as renting a car for a week to explore Ikaria or catching a plane on Europe’s low-cost carriers for a quick trip to Ireland. Or meeting family for a destination wedding.

While each month the budget varies, the total amount for the year is non-negotiable. If we overspend in June, we pay for it with money slated for November or December. Fortunately, we usually have a little something leftover at the end of the month to use later in the year because as Robie insists, we aren’t going to be afraid to spend money.

Healthcare

This is a big one, and we get it, so in our budget healthcare gets its own tab.

Medical visits in Europe are affordable and can be paid with the cash we have on hand. In Albania, Robie’s blood pressure medicine was a fraction of the cost in the States despite his employer’s quality insurance while two appointments to get our teeth cleaned came in under $50 – one-tenth the cost of two cleanings in Dallas without insurance.

The way we calculate healthcare is to set aside the amount we used to spend on insurance each month and let it accumulate. As more money gets added, the funds accrue; and with lower medical costs, our healthcare budget slowly increases. But the amount we put into this “account” comes out of our total annual expenditures so we can rest easy knowing it’s there when we need it. And in case of anything catastrophic, our emergency cash will see us safely home.

Cash & Investments

Last summer Robie started collecting social security, and since I’m several years away from the minimum threshold to withdraw, his check is our primary source of income.

With mutual funds and 401ks earmarked for the future, we won’t touch them while we travel. So, the only thing making our roving retirement possible is the sale of our home last year – a risky proposition, but one we were willing to take. And with the money, we bought CDs and put funds in high-yield savings accounts.

The interest they generate won’t make us rich, but it augments Robie’s social security check by half and reduces the amount we’ll pull out of savings this year to 15% of our total expenses. And as interest from investments increases, we’ll spend less savings to make our roving retirement a reality which means having more money leftover once we eventually settle down.

Banking

To access our money, Robie and I have three bank accounts: a traditional checking account, a high-yield savings account and a brokerage account. And since all three are with different banks, they’re linked to allow us to transfer funds easily.

We use the checking account to pay monthly bills for the storage unit, cell phones and credit card. The savings account earns interest on our money, and the brokerage account allows us to withdraw funds from any ATM worldwide without incurring banking fees. We also have two credit cards, one with an extremely high credit limit in case of emergencies and the other that doesn’t charge for currency conversion and pays cash back on every charge allowing us to earn money while not having to worry about bank fees.

We’ve read the experts who champion signing up for airline credit cards, spending the minimum to get miles and then cancelling, but that sounds like a lot of work. And with airlines continuing to raise the amount of miles needed to fly and limiting the number of mileage seats available, it’s not very appealing. So, we prefer earning cash that can be used anywhere, anytime.

Keeping in touch

When we set sail in 2008, the first iPhone had been out less than 6 months and coverage didn’t extend to the Caribbean. We kept up with friends and family by hauling our laptops into town and finding an internet café to check emails. Because even though we had a satellite phone, the device we called Drop Dead Fred had a knack for dropping calls midsentence.

Sixteen years later, we had options for keeping in touch with loved ones back home. T-Mobile is our cell phone carrier because they offer 5 megabytes of data per line in over 200 countries, and our bill is always the same as long as we don’t use their calling service. Instead, we keep in touch using Signal and WhatsApp for the technically savvy, and for our aging parents, we ring them using voice over internet protocol (VoIP) technology. Because when we’re connected to Wi-Fi and our phones are on airplane mode, incoming and outgoing calls are free.

So how are we doing?

Since setting out on this adventure, we’ve learned a lot about what not to do.

In Liverpool we blew our budget on rent and spent more on public transportation than expected. But by starting our roving retirement in England it gave us a crash course on money management and quickly transformed our mindset from “we’re on vacation” to “how can we enjoy this lifestyle and still make it last.”

When we put together the budget for this year, we forgot the annual expense that comes around every April and only ends when we die, as well as the accompanying fee from our accountant. And when a family wedding popped up in our corner of the world, we didn’t anticipate ordering $200 of goodies on Amazon for them to bring us.

But despite the challenges, we’ve somehow managed to keep our expenses in line. And to show it, we’ve including a breakdown of expenditures for March, a month we had higher than usual entertainment costs thanks to a trip to Lecce, Italy, but still a typical month.

Now that we’re halfway through the year, we’re feeling pretty good about our finances mainly because staying in Albania has been light on our wallet and given us the freedom to travel. In addition to Italy, we’ve been to Montenegro, Kosovo and will visit North Macedonia in July.

Based on the 4% guideline that suggests withdrawing no more than 4% of our savings each of the first few years of retirement, in 2025 we’re on the path to spend one-fifth that amount despite several high-end trips this year, including:

- Robie’s trip to Scotland to play golf at St. Andrews

- A trip to our niece’s wedding

- And while Cheryl and I are making a pilgrimage to Santiago de Compostela in the fall, Robie and Steve (our brother-in-law) will spend two months gallivanting around Italy

As is plain, our roving retirement isn’t about eating caviar and drinking champagne every day. It’s about traveling the globe. And with so much of the world waiting to be explored, we’re committed to taking care of the resources that allow us to see as much of the planet as possible.

Got questions? Send us a note in the comments and we’ll be happy to respond. After all, if we can do this, anyone can!

A thoughtful plan that seems to be working. Well done. Keep on keeping on!

LikeLike

Thank you for the kind words. We plan to do exactly that!

LikeLike